[print_link]

The Solow Growth model attempts to explain the features of growth we encountered in the last lecture. We need to be able to explain movements in capital accumulation, labour force growth, and technology.

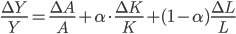

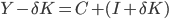

Beginning from the growth accounting equation

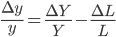

and simplifying the notation to look at accumulation in per worker ( , etc) terms with no technological change, we should see that the growth rate of real GDP per worker will be the difference between the growth rate of real GDP and the growth rate of labour, because of diminishing marginal productivity of labour. In our notation,

, etc) terms with no technological change, we should see that the growth rate of real GDP per worker will be the difference between the growth rate of real GDP and the growth rate of labour, because of diminishing marginal productivity of labour. In our notation,

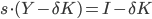

And using the same idea, we can show

.

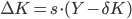

.

The equation above just says the growth rate of capital per worker is equal to the growth rate of capital minus the growth rate of labour.

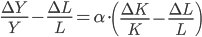

Rearranging our first equation above using the new identities, we get

But we know that in per worker terms, we can reduce this equation to

The growth of real GDP per worker depends only on the growth rate of capital per worker.

So, Solow says we should spend time thinking about policies to increase the growth rate of capital per worker in an economy in order to develop.

Solow Lesson 1: Focus on growth rate of capital per worker,  .

.

How does the growth rate of capital change?

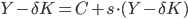

The growth rate of the capital stock depends on how much the economy saves. This is because, in the medium term, everything saved gets invested. Real income in the macroeconomy must equal the Net Domestic Product, which is GDP taking depreciation ( ) of the capital stock,

) of the capital stock,  , into account. We can define real saving as the saving rate times the level of real income, or

, into account. We can define real saving as the saving rate times the level of real income, or

Real Saving =

We know that household income equals the sum of what gets consumed and what gets saved, so the following equation must be true:

And, because in macroeconomic equilibrium savings will always equal net investment, we can say

.

.

The change in capital stock will equal gross investment (that  in the equation above), so we can write

in the equation above), so we can write

, and then because the change in the capital stock will equal gross investment minus depreciation of the capital stock, we have something like

, and then because the change in the capital stock will equal gross investment minus depreciation of the capital stock, we have something like

.

.

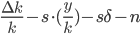

Which in per worker terms, after some rearranging, which we'll do in class, is

.

.

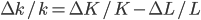

Combine this result with the requirement that the growth rate of labour should be constant, or

to get the result that the growth rate of capital per worker is dependent on the amount saved out of output per worker minus the cost of replacing depreciated capital per year minus the labour force growth rate, and we have

.

.

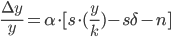

Reversing this equation and plugging in the value for the growth rate of capital per worker, we have

.

.

Phew! That was a bit of a struggle, but don't worry, we'll go through some numerical examples tomorrow. You can also download the slides and a podcast after the lecture.

You really should read Barro, chapters 3 and 4, to understand this material deeply.

Related articles

- Economics for Business Lecture 14

- Record UK goods deficit as exports drop

- U.S. economy shrank in the third quarter

- US economy officially shrinking